nc estimated tax payment calculator

Payments of tax are due to be filed on or before the 15th day of the 4th 6th 9th and 12th months of the taxable year. Beginning January 1 2023 the applicable rate is 5 of the tax not paid by the original due date of the return.

In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

. North Carolina Paycheck Calculator Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Extension for Filing Individual Income Tax Return. Just enter the wages tax.

For calendar year filers. 2022 NC-40 Individual Estimated Income Tax. Lottery Tax Calculator calculates the lump sum payments taxes on the lottery and tries to provide accurate.

These rates are the default unless you tell your payroll provider to use a. Abroad Tax Return. You can also pay your estimated tax online.

7 Mail the completed estimated income tax form NC-40 with your. To figure your estimated tax you must figure your expected adjusted gross income taxable income taxes deductions and credits for the year. Beginning July 1 2024 the applicable rate is 2 for each month or part of a month.

Individual Income Tax Sales. Your average tax rate is 1198 and your. North Carolina DMV fees are about 585 on a 39750 vehicle based on 108 in registration fees plus a vehicle property tax that varies by weight and location.

Prepare Pay Taxes. Individual Income Tax - Form D-400V. Customize using your filing status deductions exemptions and more.

When figuring your estimated tax for the. Your county vehicle property tax. Opsoreang August 15 2022 0 Comments.

Failure to pay the required amount of estimated income tax will subject the. After a few seconds you will be provided with a full. Our calculator uses the IRS standard withholding rates to estimate whats withheld from your paycheck annually.

Home File Pay Taxes Forms Taxes Forms. Find out how much youll pay in North Carolina state income taxes given your annual income. To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

2019 Individual Income Tax Estimator 2020. Our calculator has been specially developed in order to provide the users of the calculator with not. Individual Income Tax Estimator The individual income tax estimator helps taxpayers estimate their North Carolina individual income tax liability.

Each payment of estimated tax must be accompanied by Form NC-40 North Carolina Individual Estimated Income Tax. Pursuant to Notice 2020-18 PDF the due date for your first estimated tax payment was automatically. The act went into full effect in 2014 but before then North Carolina had.

For details visit wwwncdorgov and search for online file and pay. North carolina repealed its estate tax in 2013. PO Box 25000 Raleigh NC.

Nc Estimated Tax Payment Calculator. The North Carolina Tax Calculator. View the North Carolina property.

The calculator should not be used to determine your actual tax bill. This calculator is designed to estimate the county vehicle property tax for your vehicle. Individual Estimated Income Tax-Form NC-40.

Tax Calculator Estimate Your Taxes And Refund For Free

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Quarterly Estimated Tax Payments Who Needs To Pay When And Why

Irs Extends Tax Deadlines For Hurricane Ian Victims In North Carolina And South Carolina

Delaware Taxes De State Income Tax Calculator Community Tax

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Pass Through Entity Tax 101 Baker Tilly

Quarterly Tax Calculator Calculate Estimated Taxes

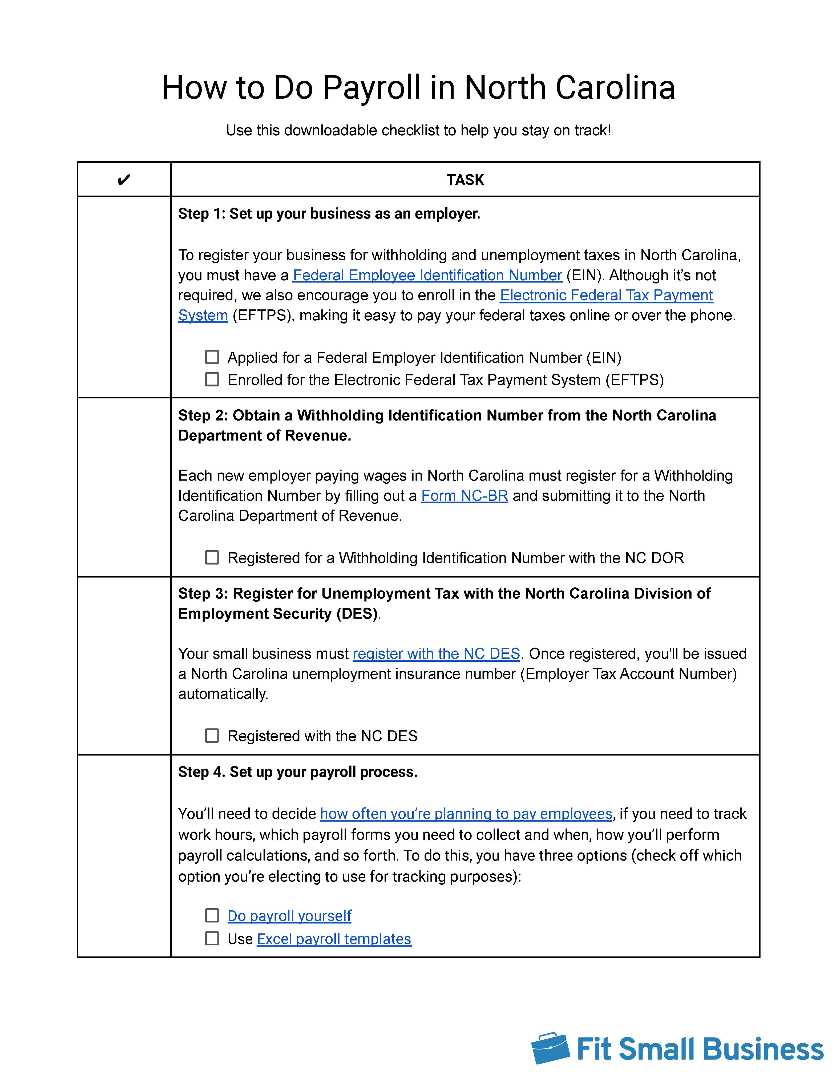

How To Do Payroll In North Carolina Detailed Guide For Employers

Llc Tax Calculator Definitive Small Business Tax Estimator

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

Estimated Quarterly Tax Payments 1040 Es Guide Dates

North Carolina Income Tax Calculator Smartasset

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Easiest Capital Gains Tax Calculator 2022 2021

Estimated Tax Payments Are Due Today Who Needs To File How To Submit And More Cnet

Tax Withholding For Pensions And Social Security Sensible Money

Tax Withholding For Pensions And Social Security Sensible Money